Dartmouth Medtech Company Turns to Equity Crowdfunding

Lodestone Biomedical aims to raise $1.2M through investments of as small as just over $100 over the next three months.

By Kelly Burch

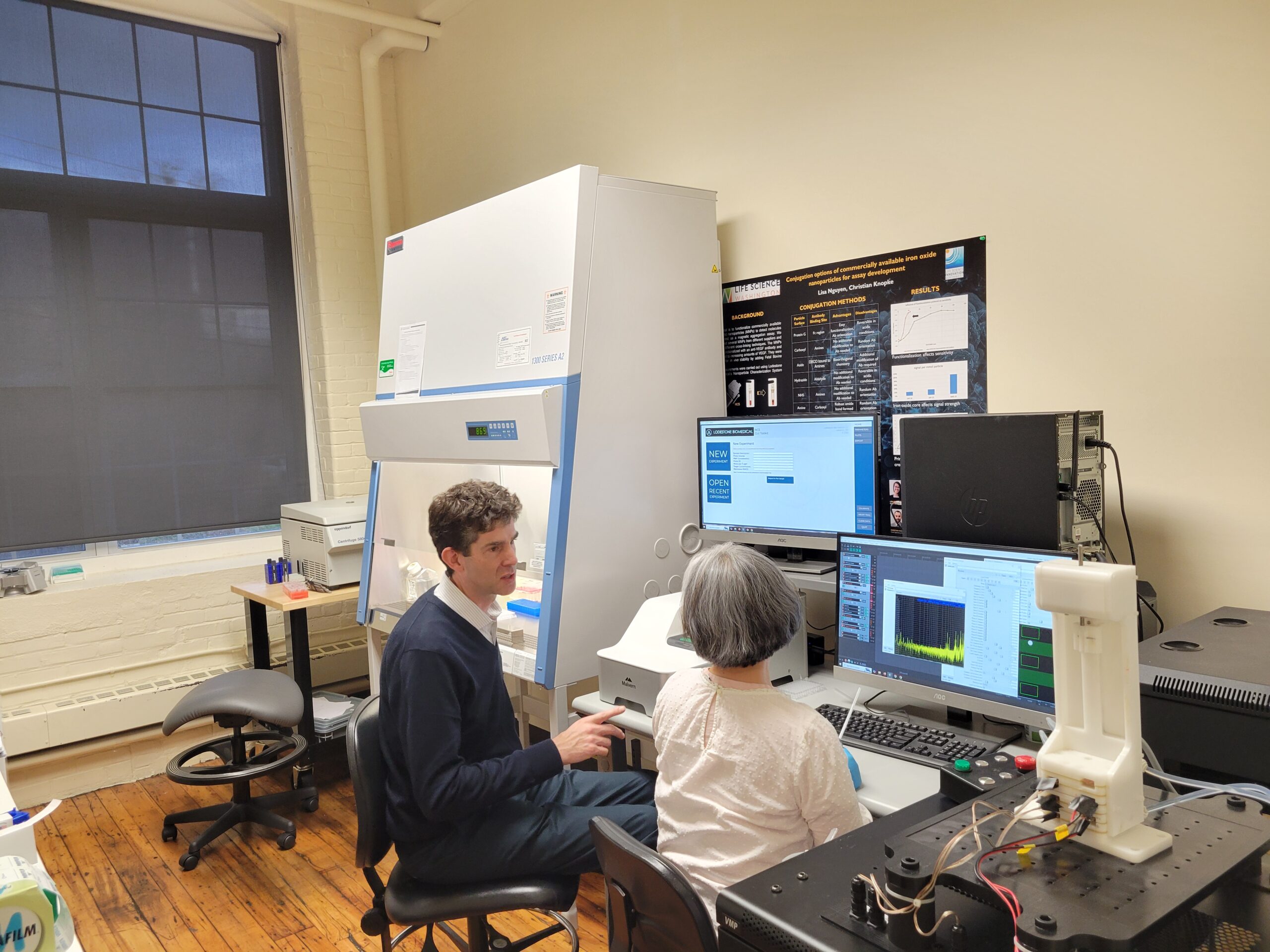

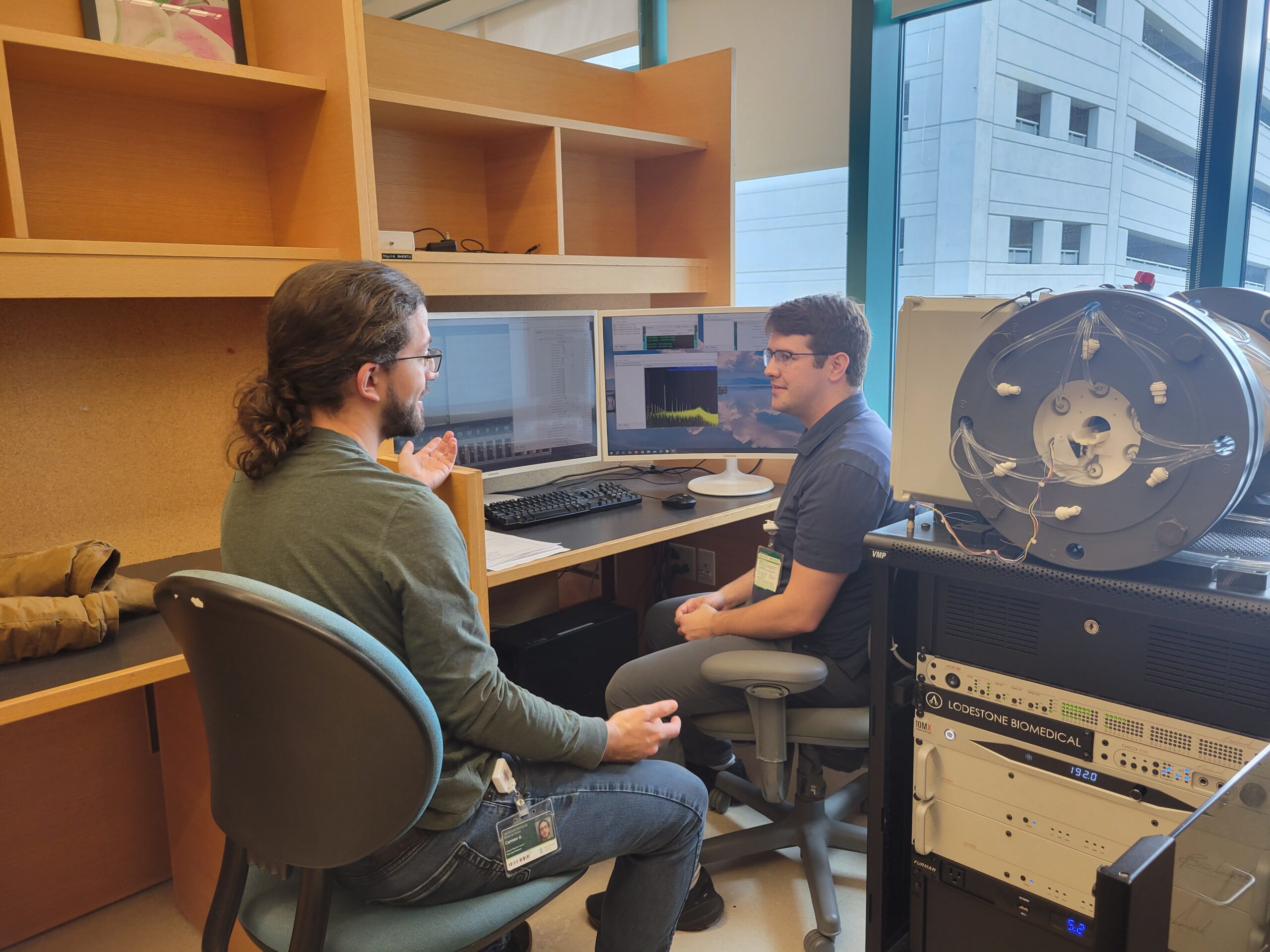

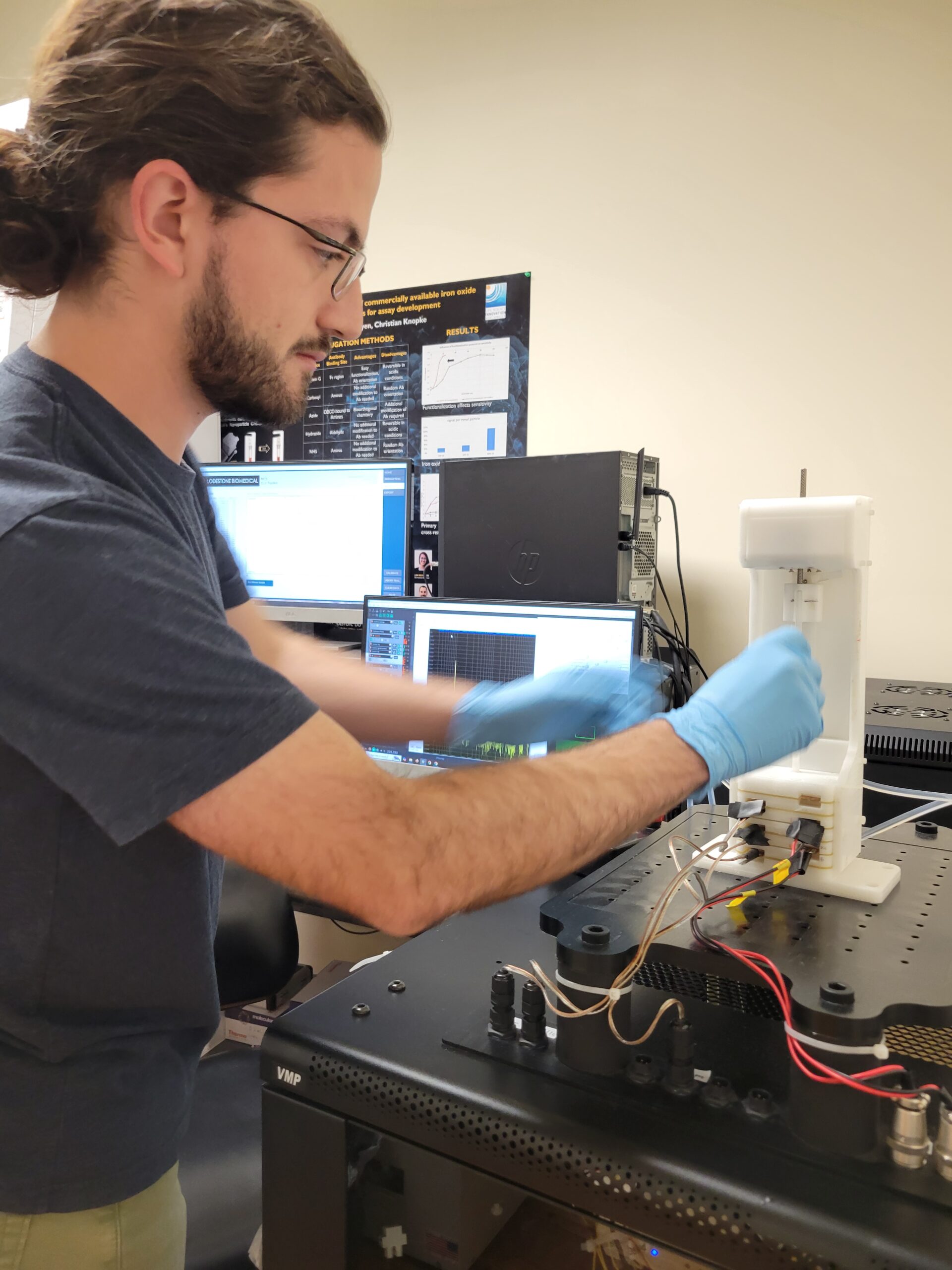

When Dr. Solomon Diamond, associate professor of Engineering, founded Lodestone Biomedical in 2015, he aimed to leverage new technology to accelerate cancer research by immediate detecting immune response during early-stage drug discovery and development. Nearly a decade later, Diamond is now utilizing another new technology to finance the continued growth of his company: equity crowdfunding.

This week, Lodestone launched a 90-day campaign to raise up to $1.235 million in working capital, through the equity crowdfunding site StartEngine. The plan is to help Lodestone pivot from government contracts to private-sector contracts.

The benefits of crowdfunding extend beyond Lodestone and could be of interest to diverse kinds of entrepreneurs and investors. By opening early-stage investment to people with just over $100 or more to invest, equity crowdfunding expands access by allowing more people to take on the inherent risks—and potential benefits—of an early-stage investment. (See StartEngine site for full terms and disclosures.)

While equity crowdfunding opens new opportunities, it is important to emphasize that these investments are highly speculative and may not be suitable for everyone. Early-stage investments involve a high risk of loss so investors who partake should be prepared to lose all their investment. It also takes patience because invested funds are illiquid and the exit opportunities for investors may be limited.

At the same time, opening early-stage investment opportunities like Lodestone also allows people within the Dartmouth community and beyond to directly participate in the development of a new technology for cancer research with the goal of developing new treatments.

“It’s not all about the money,” Diamond said. “It’s also about what we are able to bring forward to support a healthier, more vital community, family, and world.”

Developing tomorrow’s treatments

Until now, Lodestone has followed a traditional funding path. The company started as a spin-out from Diamond’s lab as one of the first companies to receive Dartmouth’s new licensing agreement that is highly favorable to faculty entrepreneurs. In the deal, Dartmouth received 4% ownership in Lodestone in exchange for granting the company an exclusive and royalty free license to the inventions from Dr. Diamond’s lab.

About three years ago the company focused in on its current direction: developing and providing technology that can monitor immune response in tumors in real time.

“This is a technology that meets a need for accelerating drug development for immunotherapy in cancer, particularly at the preclinical research and development stage,” Diamond said. “It’s a research tool for cancer centers and pharmaceutical labs to more quickly, cost effectively, and with greater insight, to develop tomorrow’s treatments.”

In its early days, Lodestone Biomedical raised roughly $1.5 million from friends and family. That funding was leveraged to secure two Small Business Innovation Research (SBIR) contracts through the National Cancer Institute, worth about $2.5 million.

With those contracts complete, the company is ready to pivot from government to private contracts—an endeavor that requires working capital. Typically, a company could seek venture capital investment at this point, but Diamond has chosen another path.

A structured investment framework

While crowdfunding has become mainstream in the age of social media, equity crowdfunding remains relatively new. Like mainstream crowdfunding, the approach relies on a large pool of participants, investing small to moderate amounts of money. However, with equity crowdfunding, investors get something in return: ownership in the company via stock.

Like many other forms of investment, equity crowdfunding is regulated by the Securities and Exchange Commission (SEC). After researching reputable platforms, including WeFunder and Republic, Diamond chose to move forward with StartEngine because of its track record in working with technology-focused startups and other academic startups.

Lodestone was required to undergo an independent financial review to qualify as a listing on the platform. While StartEngine oversees the process for SEC compliance, the company’s valuation of $12.5 million is based on Lodestone’s own analysis of comparable companies. That valuation is in turn used to set the price per share that is held constant for the duration of the campaign. Valuations for early-stage companies are always speculative and involve a high degree of uncertainty but having the valuation up front brings transparency to the raise.

Crowdfunding appealed to Diamond because it also seemed somewhat more predictable than pitching venture capitalists, despite being new.

"I really appreciate the structure of it,” he said. “The traditional route, pitching to venture funding, is sometimes likened to baseball: you’re making pitches, but they can let the balls go by all day long until they find an exact match with their niche. Then comes the dealmaking process with negotiations that sometimes fail so you can still have a swing and a miss.”

A founder might get investment on their first pitch, their 50th, or never. Crowdfunding, by comparison, offers a straightforward deal to many thousands of investors. The company sets a funding goal and the price per share, and investors are free to make their own decisions about whether to invest and how much to invest. The Lodestone campaign launched on November 18th and close about 90 days later. Anyone interested can view Lodestone’s full offering details on StartEngine, where they can find comprehensive information and all required disclosures.*

“$1.2 million a meaningful amount of working capital for Lodestone, but it’s very achievable within the crowdfunding mechanism,” he said.

“The preparations for the campaign have gone smoothly and now I’m excited to see how the campaign unfolds,” Diamond added.

A more accessible approach

Beyond his personal involvement with Lodestone, Diamond is intrigued by the idea of equity crowdfunding more broadly. Traditionally, members of the public haven’t been able to invest in companies until they’ve gone public. Usually that happens very late in the business development, when the financial risk, but also the potential rewards, are much lower.

Prior to this, only qualified investors—those who demonstrate significant wealth and assets—have been able to invest in early-stage businesses in most cases, per SEC regulations.

“That, to me, doesn’t feel right,” Diamond said.

Equity crowdfunding expands the pool of people who can try their hand at early-stage investing.

“It moves it into a range that is accessible to people with a much broader range of incomes,” Diamond said.

Like all early investments, equity crowdfunding is high-risk, but also has potentially substantial rewards.

“That can be really exciting, and one has to proceed with eyes totally open,” Diamond said. “The risks are, of course, real. And early-stage investments aren’t the right fit for everyone.”

There are also emotional payoffs for some investors. Because cancer touches so many families, Diamond frequently hears from people who want to have a material impact on his work. Equity crowdfunding allows more people to impact technologies they are passionate about, even if they’re not in the lab or the boardroom.

“There are great ideas coming out of Dartmouth all the time,” Diamond said. “It adds meaning to folks to be able to engage, vote with their dollars, receive updates, and join in the process of developing a revolutionary technology.”

*This Reg CF offering is made available through StartEngine Capital, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.